5000 Grows to 5438 1 in 2 Years Continuous Compounding Find the Interest Rate

Use our compound interest calculator to project the future value of your savings or investments over time.

How to calculate compound interest

Compound interest is calculated using the compound interest formula. To calculate your future value, multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. Subtract the initial balance if you want to know the total interest earned.

See also: Daily Compound Interest | Simple Interest Calculator | Loan Calculator

When you combine the power of interest compounding with regular, consistent investing over a sustained period of time, you end up with a highly effective way of boosting the long-term value of your savings or investments. It's a strategy of compound growth.

You can use our compound interest calculator to forecast how much your money might grow over time. The calculator creates a compound growth projection for your savings or investments over a period of years and months, based upon an anticipated rate of interest. You can try adding regular deposits to see how those additional contributions boost your balance over time.

What is compound interest?

The concept of compound interest, or 'interest on interest', is that accumulated interest is added back onto your principal sum, with future interest calculations being made on both the original principal and the already-accrued interest.

It's interesting to note that an article published in the Journal of Economic Education in 2016 suggests that less than one-third of the U.S. population comprehends how compound interest fundamentally works. 1

With this in mind, let's dive into some examples of how compound interest works and what benefits it brings...

The benefits of interest compounding

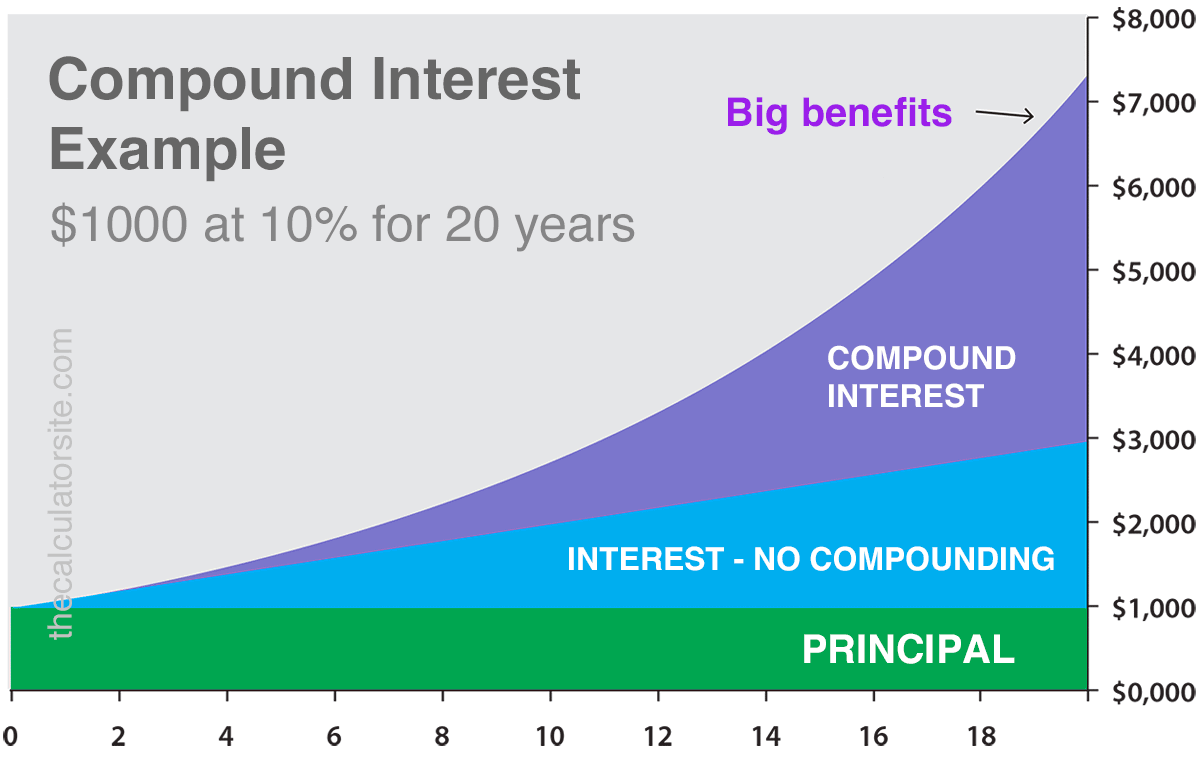

The power of compound interest becomes obvious when you look at a chart of long-term growth.

Below is an example chart of an initial $1000 investment. We'll use a longer investment compounding period (20 years) at 10% per year, to keep the sum simple. As we compare the benefits of compound interest versus standard interest and no interest at all, it's clear to see how the compound interest snowball boosts the investment value over time.

What will $10,000 be worth in 20 years?

Let's look at an example calculation. We'll say you have $10,000 in a mutual fund earning 5% interest per year, with annual compounding. We'll assume you intend to leave the investment untouched for 20 years. Your investment projection looks like this...

| Year | Interest Calculation | Interest Earned | End Balance |

|---|---|---|---|

| Year 1 | $10,000 x 5% | $500 | $10,500 |

| Year 2 | $10,500 x 5% | $525 | $11,025 |

| Year 3 | $11,025 x 5% | $551.25 | $11,576.25 |

| Year 4 | $11,576.25 x 5% | $578.81 | $12,155.06 |

| Year 5 | $12,155.06 x 5% | $607.75 | $12,762.82 |

| Year 6 | $12,762.82 x 5% | $638.14 | $13,400.96 |

| Year 7 | $13,400.96 x 5% | $670.05 | $14,071 |

| Year 8 | $14,071 x 5% | $703.55 | $14,774.55 |

| Year 9 | $14,774.55 x 5% | $738.73 | $15,513.28 |

| Year 10 | $15,513.28 x 5% | $775.66 | $16,288.95 |

| Year 11 | $16,288.95 x 5% | $814.45 | $17,103.39 |

| Year 12 | $17,103.39 x 5% | $855.17 | $17,958.56 |

| Year 13 | $17,958.56 x 5% | $897.93 | $18,856.49 |

| Year 14 | $18,856.49 x 5% | $942.82 | $19,799.32 |

| Year 15 | $19,799.32 x 5% | $989.97 | $20,789.28 |

| Year 16 | $20,789.28 x 5% | $1,039.46 | $21,828.75 |

| Year 17 | $21,828.75 x 5% | $1,091.44 | $22,920.18 |

| Year 18 | $22,920.18 x 5% | $1,146.01 | $24,066.19 |

| Year 19 | $24,066.19 x 5% | $1,203.31 | $25,269.50 |

| Year 20 | $25,269.50 x 5% | $1,263.48 | $26,532.98 |

$10,000 invested at a fixed 5% yearly interest rate, compounded yearly, will grow to $26,532.98 after 20 years.

These example calculations assume a fixed percentage yearly interest rate. If you are investing your money, rather than saving it in fixed rate accounts, the reality is that returns on investments will vary year on year due to fluctuations caused by economic factors. It is for this reason that the risk management strategy of diversification is widely recommended.

Different compounding frequencies

The more frequently your interest compounds, the more your investment balance can grow. Here are some examples of the same $10,000 investment with fixed 5% annual interest, but with different compounding frequencies...

| Compound Interval | Principal | Interest Rate | After 20 years |

|---|---|---|---|

| Yearly | $10,000 | 5% | $26,532.98 |

| Quarterly | $10,000 | 5% | $27,014.85 |

| Monthly | $10,000 | 5% | $27,126.40 |

| Weekly | $10,000 | 5% | $27,169.76 |

As you can see, after 20 years the weekly compounding has boosted the investment balance by an additional $636.78 over yearly compounding.

Using the compound interest formula

Let's look at how we calculate the year 20 figure using our compound interest formula.

Formula for compound interest

A = P(1+r/n)^nt Where:

Remember that our initial savings balance is $10,000, earning 5% interest per year. Interest is compounded yearly (once per year).

Our formula: A = P(1+r/n)^nt

- P = 10000.

- r = 5/100 = 0.05 (decimal).

- n = 1.

- t = 20.

If we plug those figures into the formula, we get the following:

A = 10000 (1 + 0.05 / 1) ^ (1 × 20) = 26532.98

The balance after 20 years is $26,532.98. Our total interest earned is therefore $16,532.98.

Compounding with additional deposits

Combining interest compounding with regular, sustained deposits into your savings account, Roth IRA or 401(k) is a super-efficient saving strategy that can really pay off for you in the longer term.

Looking back at our example from above, if we were to contribute an additional $100 per month into our investment, our balance after 20 years would hit the heights of $67,121, with interest of $33,121 on total deposits of $34,000.

As financial institutions point out, if people begin making regular investment contributions early on in their lives, they can see significant growth in their savings value further down the road as their interest snowball gets larger and they gain benefit from Dollar-cost or Pound-cost averaging. 4

More financial calculators

- How long will it take to save?

- Compound annual growth rate calculator

- Savings and investment calculator

FAQ

Some frequently asked questions about our compound interest calculator.

When is my interest compounded?

With savings accounts and investments, interest can be compounded at either the start or the end of the compounding period. If additional deposits or withdrawals are included in your calculation, our calculator gives you the option to include them either at the start or end of each period.

Can I include regular withdrawals?

You can include regular withdrawals within your compound interest calculation as either a monetary withdrawal or as a percentage of interest/earnings. This can be used in combination with regular deposits. You may, for example, wish to be contributing regular deposits whilst also withdrawing an amount for taxation reporting purposes. Or, you may be considering retirement and wondering how long your money might last with regular percentage-of-balance withdrawals.

Daily, monthly or yearly interest compounding

Our compound interest calculator includes options for: daily, monthly, quarterly, half-yearly and yearly compounding. In addition, you can include negative interest rates and inflation increases as part of your calculation.

If you're unsure how frequently the interest on your investment is compounded, you may wish to check with your bank or financial institution. As you'll have seen from our examples, it can make a big difference.

What currencies do you include?

Our interest calculator is multi-currency, allowing you to create projections using the following currencies:

- $ - Dollar (US, Australia, etc)

- £ - Pound (UK)

- € - Euro (Europe)

- ₹ - Rupee (India)

- ¥ - Yen (Japan)

Should you wish to use a currency that isn't included in these options, please use the blank currency box.

What is the effective annual interest rate?

The effective annual rate is the rate of interest that you actually receive on your savings or investment after inclusion of compounding. When compounding of interest takes place, the effective annual rate becomes higher than the nominal annual interest rate.. The more times the interest is compounded within the year, the higher the effective annual interest rate will be.

Compound interest and the rule of 72

A final thought. If you want to roughly calculate compound interest on a savings figure, without using a calculator, you can use a formula called the rule of 72. The rule of 72 helps you estimate the number of years it will take to double your money. The method is simple - just divide the number 72 by your annual interest rate.

For example, let's say you're earning 3% per annum. Divide 72 by 3, which will give you 24. So, in about 24 years, your initial investment will have doubled. If you're receiving 6% then your money will double in about 12 years, using the power of interest compounding.

References

flanigansupok1997.blogspot.com

Source: https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

0 Response to "5000 Grows to 5438 1 in 2 Years Continuous Compounding Find the Interest Rate"

Post a Comment